2024 Form 1040 Schedule 7 5 1 – Tax season — with its homeowner tax benefits — is one of the few times you may actually get some money out of your house instead of pouring money into it. Owning a house in the . Form 1040, Schedule C, Line 1 Report all money you collected in your business on Line 1 of Schedule C. This amount should include all commercial sales taxes you collected. You do not need to .

2024 Form 1040 Schedule 7 5 1

Source : www.irs.govWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2024 Form 1040 ES

Source : www.irs.gov1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS unveils new tax brackets, standard deduction for 2024 tax year

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govNew Hampshire tax filers have a new filing option, directly from

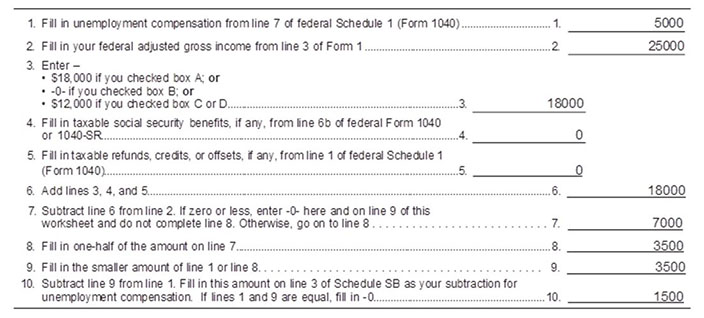

Source : newhampshirebulletin.comDOR Unemployment Compensation

Source : www.revenue.wi.govSchedule 3: Fill out & sign online | DocHub

Source : www.dochub.com2024 Form 1040 Schedule 7 5 1 1040 (2023) | Internal Revenue Service: For example, the FAQs explain: [I]f you are getting paid as a ride share driver, you could report the payment as income on your Form 1040 199-K FAQ 2. 5 Third Party filers of 1099-K FAQ 11. 6 What . But if you’ve got more things going on in your life, you may also need to get ahold of additional forms, also called schedules, to submit alongside your Form 1040. Schedule A, for example .

]]>